Tools like Grammarly, Hemingway, and Yoast can analyze content to check spelling, simplify language, and provide SEO suggestions.

ChatGPT can spit out an apparently intelligent article in seconds.

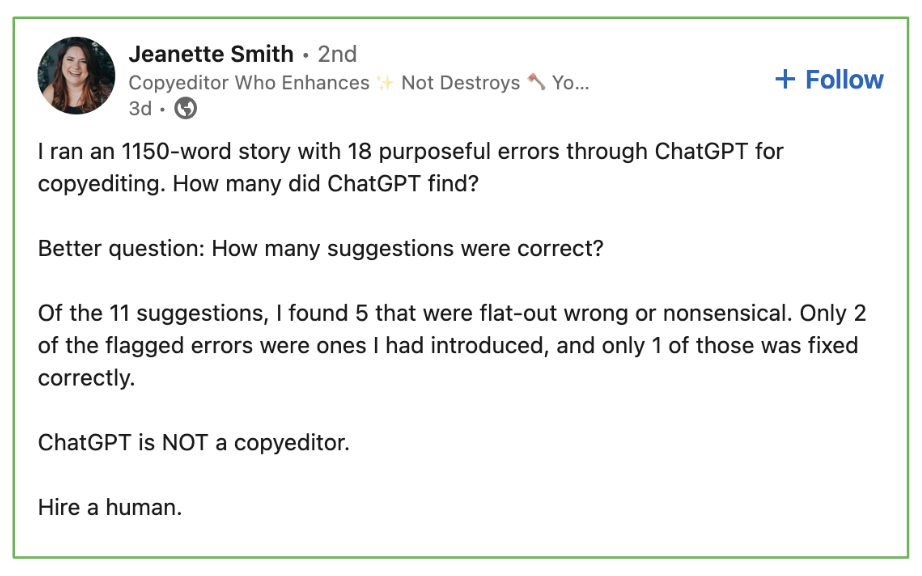

But while these AI tools can be helpful, they can also duck up your content.

Autocorrect, anyone?

Here are a few ways financial marketers can keep from getting caught up in the AI hype, while still leveraging the time-saving aspect of the tools.

Rise of the machines

The first efforts at text analysis started back in 1975 when the U.S. Navy developed the Flesch-Kincaid readability test to indicate the difficulty level of an English text. The higher the score of a given text, the easier it is to read. (Did you know most U.S. presidential candidates’ speeches are intentionally written to a grade 6-8 level.)

The Flesch-Kincaid scale is now so common that it’s bundled in most word-processing programs, such as KWord, Microsoft Word, Apple Pages, WordPerfect, WordPro, and digitized tools like Yoast and Grammarly.

Speaking of the latter two, they catch their fair share of mistakes and can definitely assist you in writing. But you can’t rely on these tools alone to produce high-quality content.

Robots like Grammarly can be persnickety about passive voice, split infinitives, and uncertain pronouns. But as one user noted, the program often glosses over prepositions, missing articles, quotation marks, verbs, conjunctions, and misplaced possessives and articles in front of proper names.

You got a problem with passive voice?

In prose, using passive voice isn’t always bad grammar, but AI loves to bring the hammer down. Slate Magazine’s Yascha Mounk once pointed out to Grammarly developers (in this tweet storm) that Hemingway was awarded the Nobel Prize for literature in 1954.

So maybe leaving some wiggle room for passive voice isn’t the worst writing idea.

As for SEO, trying to land all the elusive “green lights” on Yoast won’t necessarily guarantee results, either. In fact, you may achieve the opposite effect of high-quality content, which is spammy content.

According to one WordPress guru, Yoast’s SEO analysis is flawed on several fronts because it:

- Doesn’t take into account well-written headlines or, once the piece is published, its click-through rates.

- Only detects exact-match keywords, not partial-match. According to Moz, these keywords are an “exact match” to how someone would type them into a search bar (which is a bit shortsighted because we as human beings know there are many ways to ask questions).

- Prompts using exact-match keywords in subheads (H2, H3), causing spammy subheadings via the potential overuse of keywords.

- Prompts exact-match keywords for images even if the text doesn’t describe the image, which increases the potential for a keyword stuffing penalty from Google.

Finally, Yoast encourages increasing keyword density, which is the number of keyword matches found throughout a piece of content. But these days, Google gives more credit to the quality of content and even punishes keyword stuffing.

Organic ranking — the kind of ranking financial content marketers want — is determined by Google’s algorithm and updates that continuously improve its understanding of language and intent.

To be perfectly clear

Clear and simple writing is every content marketer’s goal, but it’s important to remember that fifth- and sixth-graders aren’t the target audience for most financial content.

Will ChatGPT and the like ever be able to wrap their neural networks around the marketing, technical, and compliance nuances required for executing great financial content? Probably not. But that doesn’t mean AI can’t help with some of the work.

However, until chatbots stop hallucinating and offering shoddy legal advice you will need human writers with real-world finance experience to do most of the heavy lifting.

Talented human editors can help ensure your content is compelling and compliant once the AI tools have done some their part.

Talented human editors can help ensure your content is compelling and compliant once the AI tools have done some their part.

But don’t just take our word for it

We were curious. What does AI “think” about all this?

So we asked ChatGPT to explain some of the reasons humans shouldn’t rely on it to write about complex financial topics.

Here is its unedited response….

![]()

“There are several reasons why relying on AI, including models like me, for complex financial topics might not be the best approach:

1. Accuracy and Timeliness: My training data only goes up until a certain point in time (April 2023 at the time of writing), so I don’t have access to or the ability to interpret real-time financial data, market trends, or recent economic events. Financial markets are dynamic, and information can become outdated quickly.

2. Contextual Understanding: While I can provide general information and insights based on historical data, my understanding of specific, current market conditions or individual financial situations is limited. Financial advice often requires a deep understanding of an individual’s personal circumstances, goals, and risk tolerance, which AI cannot fully comprehend or evaluate.

3. Regulatory Compliance and Legal Advice: Financial advice is heavily regulated, and providing personalized investment advice typically requires certification or licensure. I cannot provide legal or financial advice that complies with current regulations or adapt to changes in laws and regulations over time.

4. Complexity of Financial Products: The financial world includes a vast array of products, services, and instruments, each with its own set of rules, risks, and opportunities. While I can offer explanations of these products in a general sense, nuanced advice on investment strategies, tax implications, or specific financial planning requires expertise that goes beyond what AI can offer.

5. Ethical Considerations: Financial decisions can have a significant impact on an individual’s life. Therefore, these decisions should be made with careful consideration and, ideally, with input from qualified professionals who can provide tailored advice and ethical guidance.

6. Personalization: Financial planning and advice are highly personal and depend on individual goals, risk tolerance, financial situation, and future plans. AI models like me can provide general information but lack the ability to offer personalized, thoughtful guidance that adapts to an individual’s changing needs and circumstances.

In summary, while I can be a valuable tool for providing general information and insights on financial topics, it is essential to consult with qualified financial professionals for advice that is accurate, up-to-date, personalized, and compliant with current regulations and laws.”

Okay, okay, we also asked for a poem…

In the realm of finance where fortunes sway,

ChatGPT gives words, but tread lightly, they say.

For markets dance in real-time’s embrace.

So seek human wisdom in this complex chase.